We receive compensation from our advertising partners for links on the blog. Here’s our full Advertiser Policy.

It sometimes feels like your credit score hangs in a delicate balance like an airplane trying to avoid turbulence. Just as turbulence is inevitable when you fly into storm clouds, your credit score goes up and down on a regular basis. This can be from many credit events – including new travel credit card applications. But does applying for a credit card hurt your credit? The answer isn’t cut and dry, but an inquiry doesn’t sting as bad you think.

Does Applying For A Credit Card Hurt Your Credit?

When you apply for a new credit card, the credit card company completes a “hard inquiry” on your credit report. This is to access your credit score to make a final approval decision.

This inquiry remains on your credit report for the next 24 months. Rest assured though, it only has the largest impact in the first month or two. During that time, you’ll most likely experience a 10 to 20 point drop with each application. But you can actually boost your credit score by paying your statement balance in full every month keeping your credit utilization in good standing and creating positive monthly payment history.

The good news is that the credit bureaus usually count all credit card applications in a single 14-day window. This means your score will only drop once. But even though the credit bureaus–Experian, Equifax, and TransUnion–might only penalize your score once, the credit card companies might decline your application if you have too many recent applications.

Chase’s 5/24 Rule is the best-known example. They will decline your application for select personal and business credit cards if you’ve either applied or been added as an authorized user for at least five credit card applications in the last 24 months. This applies even if you have excellent credit.

How Long Does the Point Drop Last?

A point drop from a new credit card application usually has the largest impact for the first two months. But it could take up to six months before your score “returns to normal” or begins to improve.

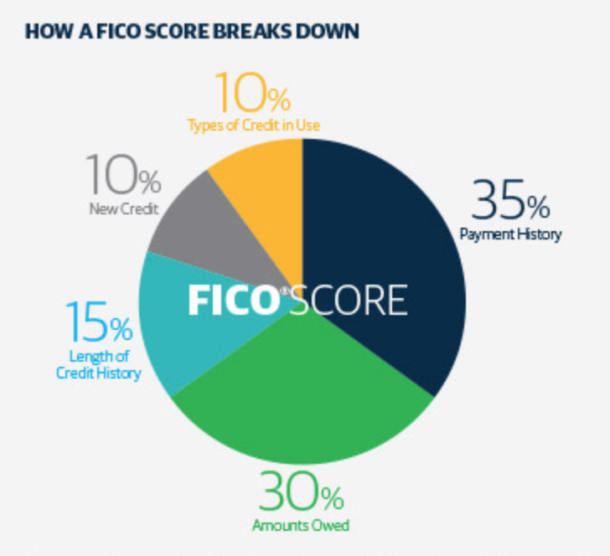

Getting approved for a new credit also alters your credit profile in:

- Payment History (35% of total credit score)

- Length of Credit History (15% of total score)

- New Credit (10% of total score)

Adding a new credit card or personal loan to your credit history can cause your credit score to drop a few points the first couple months, but adding a new credit card can actually improve your credit score in the long term.

Do Pre-Qualified Credit Card Offers Affect Credit Scores?

Does applying for a credit card hurt your credit if you have a pre-qualified offer? If you have a prime credit score, you probably receive several pre-qualified credit card offers in the mail every week. Even though the banks and credit card companies are pulling your credit score to see if you qualify for the offer, these are “soft inquiries” that don’t impact your score; just like getting a free credit score.

But if you act on a pre-qualified offer, you still need to submit a regular credit application which requires a hard application. Your credit score is only affected when you apply for a credit card.

It does seem slightly misleading that you can be “pre-qualified” for a credit. You still have to submit a formal application to be officially approved. Applying for a pre-qualified card can be helpful though. You’ll know the odds of approval are near 100% and you won’t “waste” a credit card application.

Applying for a pre-qualified offer for a rewards credit card might be the first instant credit decision you’ve ever received.

Being Added As an Authorized User Might Help Your Score

Does applying for a credit card hurt your credit if you’re added as an authorized user? Being added as an authorized user can help build your credit score without experiencing the 10 to 20 point drop that comes with a new credit card application. Some credit cards give a 5,000 point bonus if the primary cardholder adds an authorized user within the first three months of ownership.

As an authorized user, you can enjoy these benefits:

- Earn purchase rewards without paying a second annual fee

- Establish a credit history without a credit card application

- You’re not responsible for the monthly payment

Some credit experts also recommend being added as an authorized user to an old credit card account. Being an authorized user on any responsibly-handled credit account can be beneficial. But an older account can leave a better impression with the credit bureaus and lenders. A common trait of people with “perfect” credit is an average credit account history of at least 10 years.

When Being an Authorized User Can Hurt Your Credit Score

Before you agree to be added as an authorized user, remember that your credit score can decrease if the primary cardholder misses the monthly payment. It can also be negatively impacted if they have a high credit utilization ratio (i.e. the average monthly balance is $8,000 with a $10,000 credit limit).

Since the primary cardholder is probably going to be your spouse or good friend, know their spending habits well. Don’t be afraid to have a heart to heart conversation. Say “no” if you don’t feel comfortable with putting your credit score on the line.

One consequence of being added as an authorized user is it still counts as one credit card application for Chase with the 5/24 rule. Applying for a new credit card every six months will help ensure that your application doesn’t get declined.

Should You Worry About New Credit Card Applications?

So does applying for a credit card hurt your credit? Applying for a new credit card will affect your credit score, but you shouldn’t lose sleep over it. If you want to improve your credit score, paying your balance in full each month will go further. Not only do timely payments raise your score, they also help you avoid late fees and interest. Also, applying for a new credit card can increase your credit score in long term as you lower your credit utilization % and make postitive timely payments month over month.