We receive compensation from our advertising partners for links on the blog. Here’s our full Advertiser Policy.

Does the idea of applying for a travel or miles credit card make you flinch? Is your history littered with late payments and missed payments? Or have you never had a credit card before and you can’t seem to get approved? Having bad credit or no credit can be a real hindrance in accessing the financing conveniences of modern life.

However, there is one some smaller step that can build your credit back up, or for the first time. By being added as an authorized user to an existing account, you have the possibility of helping your credit report and therefore credit score. However, if not managed properly, it could have the opposite effect. This article will guide you through some key information to ensure you get the help and not the hurt. So, does adding an authorized user hurt or help your credit score?

Anytime an authorized user is added to a credit card, that information can be added to the authorized user’s credit report. From that point forward, the activity of the credit card, if reported, is added to the authorized user’s report.

Tip: being an authorized user on a credit card won’t hinder you from applying for the card yourself at a later time. And if you add an authorized user to your card you may even be able to earn more rewards.

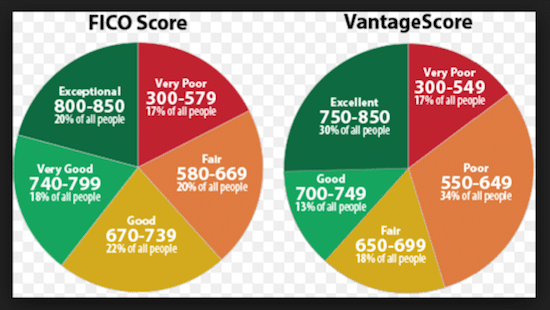

Impact on the FICO Score

When a credit report includes information about an authorized user account, it is included in the algorithm to calculate FICO’s score. However, recent changes have reduced the effect the account information has on an authorized user’s account in comparison to the primary cardholder’s.

Impact on the Vantage Score

Previously, Vantage did not take into account authorized user accounts as part of credit scoring. However, now they do use authorized user information and will have an effect on the user’s newly calculated score.

How It Can Help to Add an Authorized User

The actions and payments associated with that credit card are attributed to both the primary and the authorized users, no matter who made which interaction. A positive history with good payment schedule will reflect well on both users. In addition, having a low balance relative to total credit limit is another credit score plus. There is no requirement for significant spending or significant paperwork, making it an appealing option for people looking to build their credit.

For people looking to improve a poor credit report and score, it is very important to choose the primary card holder wisely. Oftentimes, this person may be a significant other or a parent. It should be someone who has responsible spending habits, a long and positive credit history, and good, clear communication for financial matters. It is an important choice as both parties are trusting one another with their personal creditworthiness, as good and bad financial behavior will be recorded.

If possible, it’s most beneficial to add the authorized user looking to up their credit to an older credit card with good history. This longer history reflects well on the primary user, of course, and continuing that pattern will reflect well on the new user.

On the side of the primary cardholder, the primary motivation for the new user should be to provide a means for improving the credit score. However, there can be a side perk of additional spending on the card, which can convert into rewards points, depending on the card. Some cards even provide a bonus specifically for adding an authorized user.

How It Can Hurt Your Credit Score to Add an Authorized User

As I mentioned above, the primary cardholder must be a responsible debtor. If they pay late or rack up a lot of debt, this will be recorded on both credit reports. A missed payment can stay on each credit report for up to six years, causing a negative effect for a significant amount of time. A negative hit on an already poor credit score will obviously go against the goal of having an authorized user for credit building.

On the flip side, just being associated with an upstanding debtor will not impact your credit history. The cardholder’s brilliant previous record will not be passed on to the authorized user. Only information on the shared account will be shared. The process of building credit is individual and personal and does not happen overnight. Becoming an authorized user on a reputable account is a great first step to (re)building credit, but it is but a step. In the same vein, the poor or lack of credit history of the authorized user has no impact on the credit report of the primary card holder.

Ultimately, the primary card holder makes the payments and therefore holds the responsibility for the card’s credit balance. Depending on the credit card company, the authorized user can pay the primary cardholder for purchases made or they can also be added to the account to make payments directly. Whatever the arrangement is, the authorized user is not one on the hook for the payments – the primary card holder is liable for the spending.

Or How It Can Have No Effect:

Credit card companies are not required to report the addition of an authorized user to a credit report. You may even request it to be added, but there is no way to force a company to report something on your credit report. Unfortunately, good behavior may not be rewarded if it’s not reported. Fortunately, almost all major credit card companies report the authorized user addition. Be sure to confirm with a potential credit card company about their reporting process before adding an authorized user in order to truly reap the benefit.

Conclusion

Building credit history can be a difficult process depending on your history or lack thereof. Becoming an authorized user is a valuable first step on the road to having a good and independent credit score.

However, this addition should be done with careful consideration both on the part of the cardholder and new user. Though the individual histories aren’t shared, all history of on that card, when good and definitely when bad, are recorded on each individuals’ reports. The decision should not be made lightly, but with a clear understanding of spending limits, payment responsibilities, and card use. With these features discussed and decided, the addition of authorized user can be a minor benefit for the primary cardholder and a major one for the new user.