Johnny Jet has partnered with CardRatings for our coverage of credit card products. Johnny Jet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

When comparing travel credit cards, mileage credit cards, and the Capital One Venture Rewards Credit Card is often one of the top choices listed (for good reason). The Capital One Venture bonus, the ability to earn 2x miles per $1 spent on every purchase, 5x miles on hotels and rental cars booked through Capital One Travel, and travel perks make it very appealing. But naturally, you want to get the most out of the Capital One Venture miles you are earning.

Capital One has 1:1 transfer partners plus additional exclusive airline lounges. And below we’ll show you what airlines and hotels work with Capital One miles. Here’s how to redeem Capital One Venture bonus miles for maximum value.

Contents on Redeeming Capital One Miles

Use this table to jump to specific sections in this guide:

- Earning Capital One Venture Miles for Redemptions

- Transferring Capital One Venture Miles to Travel Programs

- How to Redeem Capital One Venture Miles with Transfers to These Partners

- What Travel Programs Work with Capital One Miles?

- Think Before You Transfer Miles with Capital One Venture Bonus

- Capital One Venture Miles Travel Eraser

- Using Capital One Miles for Gift Cards

- Capital One Venture Bonus Miles Transfers to Other Venture Cardholders

- Can You Get Cash Back with Capital One?

- Summary

- FAQs

Earning Capital One Venture Miles for Redemptions

Before we get into it, let’s review the Capital One Venture Rewards Credit Card since this is the consumer travel card to use if you are looking to maximize travel.

You earn 2x miles per dollar spent on all purchases across the board. However, earn 5X miles on hotels and rental cars booked through Capital One Travel.

For a limited time, new Capital One Venture Rewards Credit Card cardholders can earn 75,000 miles once they spend $4,000 on purchases within the first three months of account opening, plus they’ll receive a one-time $250 Capital One Travel credit their first cardholder year. Earning the entire bonus is equal to $1,000 in travel!

Capital One reward miles don’t expire for the life of your account, which is great news if you want to earn miles now that can be put to use for future travel.

Those Capital One miles are then easily redeemed for everything from past travel to gift cards, new bookings, to cash back. The Capital One Venture card’s annual fee is $95. And while there are many ways to redeem miles, there are certainly some that are more valuable than others.

Note that the Capital One Venture Rewards is also one of the best contactless credit cards for your wallet. This makes it a great companion when you are looking to avoid touching many surfaces. It’s also great for international travel as it has no foreign transaction fees and comes with a fee credit of up to $100 for Global Entry or TSA PreCheck.

You can get more details in this Capital One Venture credit card review.

Bonus: Capital One Venture X Rewards Credit Card

While the Venture card is awesome, if you’re looking for a little more oomph in your travels, consider the Capital One Venture X Rewards Credit Card. This addition to the Capital One lineup includes the ability to earn unlimited:

- 10x miles on hotels and rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on all other purchases

Cardholders can also enjoy unlimited access to all-inclusive amenities at the Capital One Lounge and at Priority Pass lounges worldwide. Plus, they’ll receive up to a $100 credit for Global Entry or TSA PreCheck®.

Additional benefits include $300 back annually for bookings through Capital One Travel, where you’ll get access to thousands of options. Plus, get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary.

For a limited time, new Capital One Venture Rewards Credit Card cardholders can earn 75,000 miles once they spend $4,000 on purchases within the first three months of account opening, plus they’ll receive a one-time $250 Capital One Travel credit their first cardholder year. Earning the entire bonus is equal to $1,000 in travel!

This offer is perfect for a relaxing vacation either domestically or abroad.

Get more information in our Capital One Venture X Rewards card review. You can also visit our comparison of the Venture Rewards vs Venture X.

What Capital One Credit Cards Transfer Miles?

There are several different Capital One credit cards that earn transferrable travel miles. Consumers can transfer miles with these options:

- Capital One Venture Rewards Credit Card ($95 annual fee)

- Capital One VentureOne Rewards Credit Card ($0 annual fee)

- And The Capital One Venture X Rewards Credit Card ($395 annual fee)

Business travelers can also transfer business rewards as well:

- Capital One Spark Miles for Business ($95 annual fee, waived the first year)

- Capital One Spark Miles Select for Business ($0 annual fee)

Transfer Capital One Venture Miles to Travel Programs

Capital One Venture Rewards Credit Card cardholders can use their Capital One miles by transferring them to leading travel programs. Since there are often great ways to gain “outsized” value for various airline award charts, this represents a huge upgrade for those looking to take special long-haul vacations in the premium cabin. You can learn more in our latest post about the Capital One travel partners and lounges.

Related Article: Best Capital One Credit Cards

Transfers Partners

The list of Capital One airline partners includes 1:1 transfer partners. Plus, cardholders can transfer miles to leading travel loyalty programs, including Capital One hotel transfer partners. Capital One says that it plans to add more participating transfer partners in the future.

What Travel Programs Work With Capital One Miles

- Aeromexico (1:1 ratio)

- Aeroplan (Air Canada) (1:1 ratio)

- Air France/KLM (1:1 ratio)

- Avianca (1:1 ratio)

- British Airways (1:1 ratio)

- Cathay Pacific (1:1 ratio)

- Emirates (1:1 ratio)

- Etihad (1:1 ratio)

- EVA Air (2:1.5 ratio)

- Finnair (1:1 ratio)

- Qantas (1:1 ratio)

- Singapore Airlines (1:1 ratio)

- TAP Air Portugal (1:1 ratio)

- Turkish Airlines (1:1 ratio)

Capital One also has ALL Accor (2:1 ratio), Choice Privileges (1:1 ratio), and Wyndham Rewards (1:1 ratio) as hotel transfer partners.

What does it mean for Capital One cardholders?

These miles could be redeemed for any travel-related expense without any blackout dates. Now, some options are eligible to transfer to these programs at a rate of 1 mile to 1 mile in the partner program. If you choose to redeem your miles as a way of directly purchasing airfare through Capital One, you can still redeem them with no blackout dates on all travel-related purchases.

Examples of other reward portals include the Citi ThankYou, American Express Membership Rewards®, and Chase Ultimate Rewards® programs. Points/Miles that you can use as money for booking travel but also transfer to other programs are the best. They offer flexibility.

Think Before You Transfer Miles with Capital One Venture Bonus

Before transferring to a travel partner, see if you are better off directly purchasing airfare using your miles through Capital One bonuses. However, if you are booking travel in the premium cabin, it can be beneficial to transfer your miles to a partner. Be sure that there is award availability for the flights you want in the transfer partner’s program before redeeming. Otherwise, you will be stuck with a bunch of miles in a foreign program that you may not be able to use.

Point transfers can be ideal for booking international travel.

Keep in mind it can take up to 5 business days for transfers to complete. However, most partners complete the transfer either instantly or within 36 hours.

Capital One Venture Miles Travel Eraser

One of the best ways to get the most value out of your Capital One Venture miles is with the travel purchase eraser. You don’t have to use special booking sites or select from a limited pool of participating partner companies like with some branded airline or hotel credit cards. You just log into your Capital One Venture card account and go to your rewards page. There, you will find an option to redeem travel purchases.

When you select that option, a list of travel purchases made in the past 90 days will appear, along with the miles required to erase the purchase. You can select which ones you’d like to erase in part or in full and with a few clicks, it was like the charge never existed. Because travel purchases remain eligible for redemption for so long, you have ample time to decide which purchases are worth erasing.

Purchases made from airlines, hotels, trains, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents, and timeshares are generally considered to be travel purchases and available for redemption. Even Uber and Lyft charges make the list. You can book through a travel agent, your favorite booking portal, or straight from an airline website, whatever you prefer, as long as you use your eligible card to foot the bill.

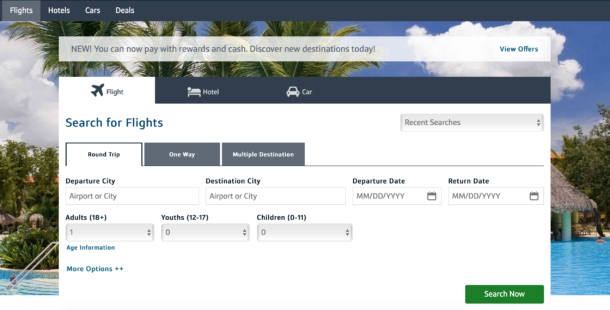

Redeeming Capital One Miles Through the Booking Portal

To pay directly with Capital One Venture Rewards Credit Card miles, you already have instead of with cash to redeem later, you can use Capital One Travel. On your My Rewards page, you can select ‘Book a Trip,’ and you’ll be directed to the Capital One Travel portal. Mile values when booking new travel remain the same (1 cent per mile), but this form of booking often prevents you from earning additional rewards on other accounts. Earning miles via two or more methods simultaneously is called double-dipping.

Booking flights with Capital One’s booking portal is often a good option as there are no blackout dates or award restrictions, and you can’t usually double dip with airlines.

Many other sites like Airbnb and Groupon also partner with frequent traveler programs that allow you to earn miles by booking through your favorite airline’s shopping portal. That means you can essentially earn double the miles (some with the airline, some with Capital One) for purchases and still erase them from your Capital One Venture card. It’s always worth checking if you can double dip before using the Capital One Travel booking site.

Use Capital One Miles for Amazon Purchases

Another non-travel redemption can be redeeming your miles for Amazon purchases.

First, link your Capital One and Amazon accounts through your credit card dashboard. When you’re shopping at Amazon.com and reach the checkout screen, there will be an option to pay with your current mileage balance. It’s possible to cover any remaining balance with cash.

While using your miles at this online retailer is an easy way to redeem your miles, you may be better off paying for your Amazon purchases with money so you can earn points. Then, you have a bigger balance to pay for upcoming trips.

If you insist on using your Capital One miles for shopping, Amazon.com redemptions are your most valuable non-travel option. You can also redeem points for gift cards or PayPal purchases, but your points are usually worth 0.8 cents for these two alternatives.

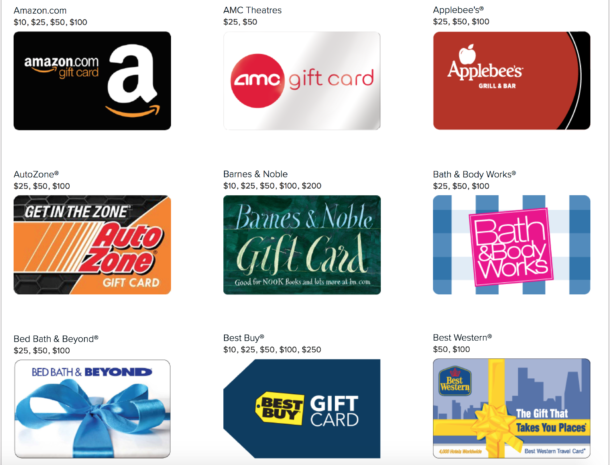

Using Capital One Miles for Gift Cards

Capital One devalued this to 0.80

If you simply must use your miles for something other than travel, gift cards are an alternative. However, you’ll only get 0.80 cents per mile value and can redeem as few as 1,000 miles for a $10 gift card. Amazon, movie theaters, restaurants, and more are just a few of the options available. There are often other ways to get deals on gift cards, though, including double-dipping by purchasing one on sale with a credit card and then using it through a frequent traveler shopping portal.

Capital One Venture Bonus Miles Transfers to Other Venture Cardholders

Can’t use your Capital One Venture Rewards Credit Card miles or want to surprise someone with the extra miles they need to book their own travel? If you would prefer to gift your Capital One Venture bonus miles to someone else with a Capital One Venture account, it’s free to do so. Miles will transfer on a 1:1 basis, so gift away. Friends or family members will thank you.

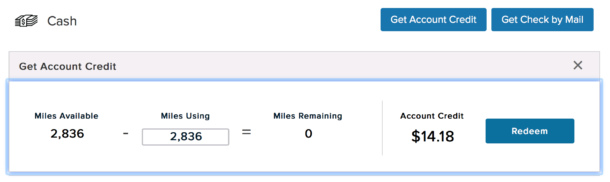

Can You Get Cash Back With Capital One?

If you’re looking for cash back, note that cash back credits should be your last option when redeeming Capital One Venture miles. You can get cash back in the form of account credit or a check in the mail, but you’ll only get half the value of any other option. That’s only half a cent per dollar, making it the least valuable way to redeem your miles.

If you’re looking for cash back, you’re better off checking out the best cash-back credit card options. Some are also fee-free, making them easy to carry in your wallet.

Bottom Line on Redeeming Capital One Venture Miles

Capital One credit cards make it easy to earn and redeem Capital One miles with the Venture card. It offers maximum flexibility with minimum complications. Being able to spend normally and then decide what purchases to erase is a key feature of the Capital One Venture Rewards Credit Card. It might be one of the least complicated cards out there. Add to that the varied redemption options and good point value for all purchases across the board, and it’s a pretty solid choice.

For those seeking an easy-to-use card that doesn’t require dedicated booking portals or constantly fluctuating point or mile-earning values, the Capital One Venture card should be high on your list of travel cards to consider.

Related Posts:

- TSA Precheck Credit with Capital One Venture

- VentureOne vs Capital One Venture

- Credit Score Needed for Capital One Venture

FAQs

How do Capital One Venture miles work?

The Capital One Venture Rewards Credit Card earns unlimited 2x miles per $1 on all purchases. However, earn 5x miles on hotels and rental cars booked through Capital One Travel.

You earn the same amount of miles for U.S. and international purchases.

You can redeem your Capital One Venture miles for travel, cash, and gift card rewards. Although your miles are usually most valuable when redeemed for travel statement credits, booking upcoming travel, or transferring to airline or hotel partners.

How do I redeem Capital One Venture miles?

Your Venture miles can be redeemed for travel, cash, and gift card rewards in your Capital One online account. You can redeem your miles in any amount for most reward options.

Each point is worth 1 cent each (i.e., 10,000 miles=$100) for travel statement credits (travel purchases within the last 90 days) and booking upcoming travel on the Capital One travel booking site. You can also transfer your miles to select airlines and hotels where they can be worth more than 1 cent each.

Venture miles are usually worth less than 1 cent each when redeemed for cash rewards or gift cards.

One final option is transferring your miles at a 1:1 ratio to other Capital One Venture cardholders.

How much are Capital One Venture miles worth?

Each Capital One Venture Rewards Credit Card mile is worth 1 cent each for travel statement credits and booking upcoming travel through the Capital One travel booking site powered by Orbitz. Redeeming 10,000 miles is worth $100 for these two redemption options.

You might be able to make each point worth more than 1 cent each by first transferring your miles to an airline partner and booking a flight directly from the airline.

Your miles are less valuable when redeemed for cash or gift cards. The average point value is only 0.8 cents. For example, 10,000 miles are only worth $80.

How Many Venture Miles For a Flight?

You will need 10,000 miles per $100 in flight costs. Each mile is worth 1 cent for award travel with the Capital One Venture Rewards, Capital One Venture X Rewards, or the Spark Miles for Business Credit Card.

It’s possible to pay with miles and cash through Capital One Travel if you don’t want to use 100% points to book a flight. Additionally, the travel booking site is powered by Hopper, which offers price prediction and price protection tools to help find the lowest price.

Can You Combine Capital One Miles?

Yes, you can combine the miles you earn between your Venture and Spark Miles credit cards. It’s also possible to transfer your miles to or receive miles from another Capital One customer with a Venture or Spark Miles account without transfer fees.

Related Articles:

- Can You Receive a Capital One Venture Bonus Twice?

- The Best Metal Credit Cards

- Best Credit Cards for Domestic Travel

Johnny Jet has partnered with CardRatings for our coverage of credit card products. Johnny Jet and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Very useful information and so good suggestions for a prudent buyer and traveler.

So, when you use a purchase eraser, does that then cancel any miles redeemed with that purchase? For example, I get my 50,000 bonus miles and use that to erase $500 of spending on a hotel. Would I then lose the 2x miles I had earned on that purchase originally?

Also, do you still earn 2x miles on the initial purchases made that add up to the first $3000 used for the bonus miles?

You will still earn the miles for the purchase. Yes, you earn 2x miles while you’re meeting your spending requirement.

A capital one agent told me that using the last option “Cash” will have the same value as the travel eraser IF I select credit my account. I’ve just read this site and it says the value is much less.

Whose is correct?

A capital one agent told me that using the last option “Cash” will have the same value as the travel eraser IF I select credit my account. I’ve just read this site and it says the value is much less.

Whose is correct?

You will only receive half the value when redeeming your Capital One Venture miles for cash.

I am about to book a hotel through the hotels.com/venture site. Can I erase the charges from my card using travel eraser. I would assume so but am not sure because they are a partner with Capital one

Yes, you can use your Capital One miles for hotels.com purchases.

What kind of credit score do you need to get approved?

A credit score over 700 is your best bet on getting approval, but there are no guarantees.

Can reward points with capital venture/bookings card be utilized with all airlines…and at what ratio? Ie american or united airlines?? Thank you!

Capital One miles don’t transfer to American or United Airlines directly. However, you can transfer them to a Star Alliance or One World airline and then book AA or United. For example, you can transfer your miles to Avianca and then book United flights because its in the same alliance.

Hi,

I’m booking travel from Austin to Amsterdam using my Capital One Venture rewards. I also checked the price of the exact flight itinerary via American Airlines website. The cost of the ticket if I booked it through AA site is twice as much as the Cap One portal price. Are their hidden costs that aren’t included in the Cap one fare? I’m trying to understand why the significant fare difference. Thanks!

I’m not sure, but you can click through the process to see the final payment. Also, you may be able save more money by transferring your Capital One Miles to a transfer partner and then booking your award. Generally, that’s where the value is. Hope this helps.1

Hi Johnny. Does an airline know where I earned my miles? For example, I have about 300k American Airlines miles that I earned entirely through Citibank cards. Does American know that I did not earn those as a flyer, but rather as a Citibank cardholder? I’m wondering if that makes me a lesser value customer than if I earned those miles through flights. Maybe it doesn’t really matter to them.

Hey Gerald, AA knows how miles are earned because miles earned flying on revenue flights earn their elite status. Other than that it really doesn’t make a difference since once you have AA miles you can redeem them the same way. Hope this helps!

Maybe a stupid question….. But I’m having a hard time finding an answer. I just got the Venture card. If I make travel purchases like booking flights, hotels, etc., then fully pay my statement to avoid interest, then spend the $3,000 in 90 days and get the 50,000 bonus miles… Can I use those points to offset the travel purchases I’ve already paid off? Does the mile redemption basically appear as a redemption credit on the next statement?

Yes, you should be able to as long as the Capital One miles post before then you can use them for those purchases. My miles posted before my next statement as a data point.

I’m logged in to my account and looking to get gift cards. However, they are all at .80 per 100 points instead of 1=1. Your article says it is 1=1. How do I get the full value?

Sorry for the confusion, Capital One recently devalued gift card redemptions to 0.80.

I appreciate you for spreading this data about this awesome weblog. let me promote this post in my small tumblr take into account my girlfriends

Can I use my rewards for a hotel stay for my anniversary in a nearby city?

Yes, you can book online through the Capital One portal.

i dont see like delta, fontier, allegient or other well known airlines on the list of partnering airlines. how do i know that the airlines that i use the most will be covered?

also- lets say my ticket is 500$ and i have a credit or 300$ can i apply that to make my ticket 200$ or do i have to have enough to cover the whole ticket?

You can redeem your Cap One miles for a travel statement credit for those airlines that aren’t transfer partners. Yes, a $300 credit on a $500 ticket would make it $200.

Hi. Great website.

I’m having trouble grasping the idea of double dipping with hotel purchases. You say:

“Booking through Hotels.com/venture, for example, will earn you 10x miles on purchases made to your Capital One Venture card. You can then erase those bookings via the purchase eraser, allowing you to earn Capital One Venture bonus miles as you redeem them.”

How are you earning bonus miles AS you redeem them?

Basically, you could pay for your hotel stay by erasing its costs with points. But, yes, you would still earn the 10x miles on your Hotels.com purchase. Hope this helps!

Okay. If I purchase my flight through another credit card portal (I have Wells Fargo Propel and get better value than 1:1 if booking through the WF portal using my WF propel card) using a combo of points and cash, can I use the Capital One purchase eraser on the cash/money spent on that flight?

Just to confirm, I recently made a $4200 hotels.com booking for an All-inclusive, so I will earn 42,000 points for that booking and can use it to take $420 off the cost of that same booking, correct?

Yep, you can use the point eraser for that purchase.

Cathay Pacific Asia Miles: Asia Miles uses a distance-based award chart, so unfortunately, Cathay Pacific flights from the U.S. to Asia wind up falling on the expensive side of things. Still, it might be worth paying up for one of the world s best first-class products or for nonstop flights to Asia from cities like Boston or Washington, D.C. You can also find good values on some shorter domestic AA flights, and on Oneworld flights from the East Coast to Europe, though you ll also need to contend with the carrier s challenging award booking engine .

Thanks for the great write up. The only point that I think needs a little more clarification is the cash back option. I agree that this looks like the worst choice available, but you mention that the cash back option only provides a benefit of “half a cent per dollar” spent. From your screenshot it shows that two miles are equal to one cent, but you actually earn two miles per dollar spent. This means the cash back option is worth one cent per dollar spent. Each mile might be worth one cent when redeemed for travel and you are only getting half of that when you redeem for cash back, but cash back is still equal to one cent per dollar spent.

I’m planning on going to Italy next Fall. Can the points eraser be used toward Airbnb purchases or even train tickets?

Yes, you can use your Capital One miles to erase Airbnb purchases.

Thanks for your prior response! if i buy tickets through justfly.com will i still be able to erase those points?

can I use my capital one venture points to pay off my bill with cap one?

Yes, you can but the value you get depends on the transaction.

How do I use the points for wish .com

I’m not sure if they are a portal partner, but you can always use your points for a statement credit, but it’s a lower redemption value.

I’m booking a $5200, all-inclusive trip thru a travel agent. Do I pay for the whole trip with my venture card. Will that give charge give me points I can use to bring down that total cost. Or do I have to book thru cap 1 travel portal

Yes, you would be able to redeem your points earned from the travel purchase to bring down the cost after the fact.

Thanks for all your research and input. I am planning on using Capital One Venture visa to purchase european travel tour (Zurich tour includes bus/ferry/alps- takes about 9 hrs), listed through Tripadvisor website. Under Capital One app, it offers 10% discount if I go through Capital One portal to get to Tripadvisor. I know I will get the 10% discount, but will this qualify for travel related, so I can use Capital One Venture travel miles to erase purchase?

Can I give my points to a relative for their airline trip to visit me?

If so, how would I do that?

You can’t give them your points but you can use your points to book them a ticket

Hey Johnny,

I feel like I’m missing something because this seems to be far and away the best option for those of us who travel. Please tell me if my assumptions are correct:

Let’s say I spend $10,000 on the card. That gives me 20,000 miles. If, say, I book a ticket on Delta that costs $200, I can then use those 20,000 miles to “erase” the ticket cost?

Isn’t that effectively a 100% bonus? I currently have a Chase Sapphire Preferred card that earns me 1 mile for every dollar spent…. but allows me 1.25-to-1 when booking through their Ultimate Rewards site thus giving me a 25% bonus.

I seems too-good-to-be-true that this card gives me the equivalent of a 100% bonus vs my current card of 25%.

Am I missing something obvious here?

Thanks!

I believe in your scenario it does make more sense to redeem the Cap One miles. However, Chase points have some better transfer partners. That’s why I have both cards :)

I have forgotten my User Name and Password and I am having trouble resetting them.

I want to redeem my Capital One Venture rewards for cash option. I have called every telephone number listed on your website but I cannot seem to connect with anyone to help.

Would you please reply with a correct telephone number that can help me with this.

The name of the person to ask for along with the direct telephone number would be very helpful.

Thanks.

Hi P. Heddins, thank you for your question. You can visit this site specifically for assistance on your password and user name: https://www.capitalone.com/help-center/credit-cards/sign-in-support/

Additionally, while we don’t have a specific person with a direct telephone number, I have found the following numbers that you can try:

1-800-CAPITAL (1-800-227-4825)

1-877-383-4802

You can also try this digital chat option: https://www.capitalone.com/digital/eno/

If you are near a Capital One branch, you may also try visiting in person: https://locations.capitalone.com/