This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

With so many great credit cards you can try in 2024, it’s easy to feel overwhelmed. You may want your card to earn cash rewards, enjoy exclusive benefits, or work on building credit. Below are the best credit card reviews from our expert writers. I’ve personally held a majority of these cards. If there’s a credit card review that interests you, click the link for our in-depth ‘best credit card review’ posts.

Best Credit Card Reviews in 2024: Travel Rewards Cards

The best travel credit cards usually have higher redemption values than cash rewards. These flexible travel credit cards let you earn and redeem bonus points with multiple travel carriers.

Chase Sapphire Preferred Card

The Chase Sapphire Preferred® Card is one of the best travel rewards cards for any traveler. Earn 5x points on travel purchased through Chase Travel℠, 3x points on dining, and 2x points on all other travel purchases. Points are worth 25% more when booking award travel, and you have 1:1 point transfers to airlines and hotels, including United, Southwest, Emirates, and Hyatt. Find out more: Chase Sapphire Preferred Card Review

Capital One Venture Rewards Credit Card

Earn at least 2x miles on every purchase with the Capital One Venture Rewards Credit Card. You can redeem your Capital One mile for travel statement credits, book upcoming travel, or transfer to leading travel loyalty programs. The annual fee is $95. Find out more: Capital One Venture Card Review

The Platinum Card from American Express

The Platinum Card® from American Express earns 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year, and earns 5x Membership Rewards® Points on prepaid hotels booked with American Express Travel. Points can be transferred on a 1:1 ratio to British Airways, Delta, Emirates, and other airline partners. Frequent flyers will also enjoy access to several airport lounge networks and a fee credit for Global Entry or TSA PreCheck, as well as CLEAR perks (Terms apply). The annual fee is $695 (See Rates & Fees) but can be offset with the perks, which are valued at over $1,400. Find out more: American Express Platinum Review

Chase Sapphire Reserve

One of the most flexible premium travel credit cards is the Chase Sapphire Reserve®. Earn 5x total points on air travel and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining. Get a 50% travel redemption bonus or transfer points to the Chase Ultimate Rewards travel partners. Card benefits include a $300 annual travel credit, Priority Pass lounge membership, and Global Entry or TSA PreCheck fee credit. Find out more: Chase Sapphire Reserve Review

American Express Gold Card

Enjoy up to $120 in dining credits (enrollment required) with the American Express® Gold Card. The American Express® Gold Card earns:

- 4x Membership Rewards® points per dollar spent on purchases at restaurants worldwide (on up to $50,000 in purchases per calendar year, then 1x points for the rest of the year)

- 4x Membership Rewards® points per dollar spent at U.S. supermarkets (on up to $25,000 in purchases per calendar year, then 1x points for the rest of the year)

- 3x Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com

- 2x Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com

- 1x Membership Rewards® points per dollar spent on all other eligible purchases

You can transfer your points to the 1:1 airline and hotel Membership Rewards transfer partners. This card has an annual fee of $325 (See Rates & Fees), which can easily be offset by the perks. Find out more: American Express Gold Card Review

Citi Premier Card

The Citi Premier® Card earns 3x points on air travel, hotels, supermarkets, restaurants, and gas stations. There is also a $100 annual hotel benefit. You can transfer points to select airline partners. Find out more: Citi Premier Review

Citi Prestige Credit Card

The Citi Prestige® Credit Card’s most valuable benefit is getting the 4th hotel night free on a 4+ night stay (up to two times a year). Air travel and restaurant purchases earn 5x points per $1. Hotel and cruise line purchases earn 3x points per $1. Other travel benefits include a $250 travel credit and Priority Pass lounge membership. Find out more: Citi Prestige Review

Further Reading:

- Best Travel Credit Cards For Beginners in 2024

- Is Getting a Travel Credit Card Worth It? Here’s What To Consider

- Best No Annual Fee Travel Credit Cards for 2024

- Credit Score Needed For The Best Travel Rewards Credit Cards

- The Best Credit Cards For International Travel In 2024

Credit Card Reviews 2024: Airline Credit Cards

Co-branded airline miles credit cards honor your loyalty by offering perks that can save you money each time you travel with them.

Delta SkyMiles Gold American Express Card

You and up to 8 travel companions get the first checked bag free on Delta flights with the Delta SkyMiles® Gold American Express Card. Additionally, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com. Cardholders can also get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Find out more: Best Delta Credit Cards Review

Southwest Rapid Rewards Priority Credit Card

The Southwest Rapid Rewards® Priority Credit Card is the ultimate card for Southwest Airlines flyers. Perks included 4 Upgraded Boardings per year, 25% back on inflight purchases, and a $75 annual Southwest travel credit. Purchases earn up to 3x Rapid Rewards points, which also qualify for the standard Southwest Companion Pass® point requirement. Find out more: Best Southwest Credit Cards Review

United Explorer Card

Earn 2x miles on dining (including eligible delivery services), hotels, and United® purchases with the United℠ Explorer Card. United Airlines benefits include 25% back on United® inflight purchases, the first checked bag free for you and one companion, two one-time United Club passes each year, and Global Entry or TSA PreCheck fee credit. Find out more: Chase United Explorer Card Review

Further reading:

- Do United Miles Expire? Learn More About United’s Policy

- Do Delta SkyMiles Expire? The Answer May Surprise You

- Also, Do Travel Airline Miles Expire?

- Do American Airlines Miles Expire?

Credit Card Reviews: Hotel Credit Cards

The best hotel credit cards usually have free hotel night vouchers. You can also enjoy enhanced loyalty status, among other perks.

IHG One Rewards Premier Credit Card

Enjoy an Anniversary Free Night at IHG Hotels & Resorts. Plus, enjoy a fourth reward night free when you redeem points for a consecutive four-night IHG® hotel stay. Cardholders also get automatic Platinum Elite status with the IHG One Rewards Premier Credit Card as long as they are cardholders. A Global Entry, NEXUS, or TSA PreCheck fee credit is also an added bonus. Find out more: IHG One Rewards Premier Credit Card Review

World of Hyatt Credit Card

Enjoy several free nights every year, depending on how much you use your World of Hyatt Credit Card. You will receive 1 free night after your cardmember anniversary and an extra free night if you spend $15,000 during your cardmember anniversary year. You also get automatic World of Hyatt Elite status and 5 qualifying night credits annually. Hyatt purchases earn up to 9x points. Find out more: World of Hyatt Credit Card Review

Further Reading:

- The Capital One Premier Collection Offers Luxury Hotels

- The Best Hotel Credit Card Offers For Various Occasions

- Earn Free Hotel Nights Via Your Spending With These Credit Cards

Credit Card Reviews 2024: Cash Back Credit Cards

Get the highest cash rewards with some of these best cash-back credit cards.

The Blue Cash Everyday Card from American Express

Earn 3% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%), 3% cash back at U.S. gas stations (up to $6,000 per year in purchases, then 1%), 3% cash back on U.S. online retail purchases (up to $6,000 per year in purchases, then 1%), and 1% cash back on general purchases with The Blue Cash Everyday® Card from American Express. Cash back is received in the form of Reward Dollars that can be redeemed for statement credits or at Amazon.com at checkout with this $0 annual fee card (See Rates & Fees). Find out more: American Express Blue Cash Everyday Card Review

Capital One Savor Cash Rewards Credit Card

The information for the Capital One Savor Cash Rewards Credit Card has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

The Capital One Savor Cash Rewards Credit Card is ideal for dining, entertainment, and select streaming purchases as you can earn an unlimited 4% back. You’ll also earn an unlimited 3% back on grocery store purchases. Cash rewards are redeemable in any amount. Find out more: Capital One Savor Cash Rewards Credit Card Review

Chase Freedom Flex

Earn up to 5% back on quarterly bonus purchases and an unlimited 1% back on everything else with the Chase Freedom Flex®. This card doesn’t have an annual fee. Find out more: Chase Freedom Flex Review

Further Reading:

- Cash Back vs Travel Rewards Credit Cards for 2024

- The Best Cash Back Credit Card Offers in 2024

- Best Credit Cards For Groceries in 2024: Up to 6% Cash Back

Credit Card Reviews: Cards To Build Credit

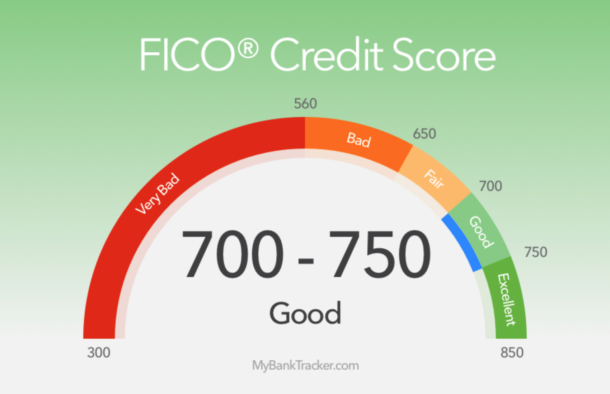

These can be the best credit cards to boost your score if your credit score is in the 500s or lower 600s.

Capital One Platinum Credit Card

You can receive a higher credit limit after making your first 6 monthly payments on time with the Capital One Platinum Credit Card. This card doesn’t have an annual fee. Find out more: Capital One Platinum Credit Card Review

Discover it Secured

The Discover it® Secured doesn’t charge an annual fee and earns up to 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases every quarter. Your credit limit is equal to your refundable security deposit. Find out more: Best Discover Credit Cards Review

Related Reading:

- Best Credit Card To Build Your Credit Score?

- Best Places to Get Free Credit Score Checks Without Affecting Your Credit

- Does It Help Your Credit Score By Getting A Credit Card?

Credit Card Reviews 2024: Business Credit Cards

These are some of the best small business credit cards (2024) that can boost your business spending.

Ink Business Preferred Credit Card

Travel and select business purchases, including online advertising and shipping earn up to 3x Ultimate Rewards points with the Ink Business Preferred® Credit Card (only on the first $150,000 spent annually, then 1x per $1). Points are worth 25% more when booking award travel, and you can transfer to the 1:1 Chase travel partners. Find out more: Ink Business Preferred Card Review

American Express Blue Business Credit Cards

Get 2% cash back or 2x Membership Rewards® points per $1 on the first $50,000 in annual everyday business purchases (then unlimited 1% back or 1x points) with either The American Express Blue Business Cash™ Card (for cash back in the form of a statement credit – (See Rates & Fees)) or The Blue Business® Plus Credit Card from American Express (for travel rewards – See Rates & Fees). Rewards points are redeemable for cash, travel, or 1:1 Membership Rewards point transfers. Find out more: Amex Blue Business Credit Cards Review

American Express Business Gold Card

Earn up to 4x Membership Rewards points on 2 select categories where your business spent the most each month (on up to $150,000 spent annually, then 1x point) with the American Express® Business Gold Card. The annual fee is $375 (See Rates & Fees). Find out more: American Express Business Gold Review

The Business Platinum Card from American Express

With The Business Platinum Card® from American Express, you’ll earn 5x points on flights and prepaid hotels booked through AmexTravel.com. Enjoy travel perks like a $200 annual airline fee credit (in the form of statement credits at one qualifying airline for checked baggage fees, lounge day passes, and more) and airport lounge access (enrollment required). The annual fee is $695 (See Rates & Fees). Find out more: Amex Business Platinum Card Review

Southwest Rapid Rewards Performance Business Credit Card

Earn up to 4x Rapid Rewards points on Southwest purchases with the Southwest® Rapid Rewards® Performance Business Credit Card. Enjoy free inflight WiFi credits and 4 Upgraded Boardings per year. Receive 9,000 bonus points every card anniversary. Find out more: Southwest Airlines Business Credit Card Review

Further Reading:

- People Ask: Does Chase Have Good Business Credit Cards?

- The Best American Express Business Cards for 2024

- What Are The Best Business Credit Cards For Airline Miles?

- The Best Business Checking Accounts for Use In 2024

Summary of Credit Card Reviews

These credit card reviews make it easy to optimize your wallet. By narrowing down your options, you can find the card that makes the most sense for your spending habits. Boosting your purchase power can help you save money when redeeming points for future purchases or vacation bookings.

Credit Cards: Definition and Information to Get Started

What is a Credit Card?

A credit card is defined as a plastic card issued by banks that allows you to borrow money and make purchases. Credit cards follow the “buy now, pay later” model. Unlike debit cards, which automatically withdraw the money from your bank account, credit cards keep a running balance like your water or electric bill. Once your credit card application is approved, the credit card company assigns you a credit limit.

If your credit limit is $10,000, you can spend up to $10,000 before your transactions will be declined. You can make daily balance payments, but each month, you will receive a monthly statement that tells you how much you owe on the statement’s closing date. Your credit score can be improved by paying your payments every month on or before the due date.

Your credit card company reports your payment history to the credit bureaus every month. Making payments on time improves your credit score, while missed or late payments will damage it. You can access your credit score for free and use the score simulator to see how each credit event will affect your score. Some credit cards charge an annual fee. Credit cards that charge annual fees tend to offer better rewards or card benefits, but there are plenty of no-annual-fee credit cards that let you build your credit score for free!

Read More About Credit Card Basics

What is a Credit Score?

Credit cards are issued by banks and have a maximum limit for what the cardholder can borrow. This amount is called a “credit limit.” Credit limits are determined by several factors that make up a credit score. The most common factors are your income, your debts, and how much money you are currently borrowing.

There are several websites that will offer you a free score and recommend credit cards that they think you have high odds of being approved for. These sites may receive some monetary compensation if you apply for a card or loan through their website.

Although you can apply for a credit card through their website, don’t feel obligated to apply just because they give you a free credit score. Most of the sites also let you take a peek at your credit report for free once a year in addition to getting a free credit score. They give you information like the top reasons why your score is good and what you can do to improve it. These free credit score websites also come with a calculator, which allows you to predict how credit events like applying for a new credit account or making on-time payments for six straight months or how it will impact your score.

Read More About Credit Scores

- Are Free Credit Score Sites Reliable Or a Waste of Time?

- Does It Help Your Credit Score By Getting A Credit Card?

- How to Check Your Business Credit Score

- Does Applying For A Credit Card Hurt Your Credit Score?

- Best Places to Get Free Credit Score Checks Without Affecting Your Credit

- What Are Some of The Easiest Credit Cards to Get Approved For?

- 3 Tips to Prevent Credit Card Closures

What Are the Different Types of Credit Cards?

Credit cards have evolved to fit a wider variety of needs in conjunction with an ever-changing market. Consumers have changed and will likely continue to influence further financial innovation. To help meet the challenges that consumers face, credit card issuers have created new categories and subcategories that target specific demographics.

Are you a student? There are credit cards for you. Are you loyal to a certain hotel or airline? Earn perks for your purchases. Do you have a small business? Take advantage of the ability to keep your personal and business expenses apart.

However, all of these cards fall under three main categories: student, personal, and business.

Student Credit Cards

Student credit cards are for those with little to no credit history to help them build credit. However, many of these cards do have a higher interest rate. Often, lenders are willing to give students special offers due to their spending potential as they transition into their careers.

Personal Credit Cards

Personal credit cards are the umbrella that most credit cards fall under. These consumer cards vary by lender, credit standing, and personal credit history. Their benefits, spending limits, and ease of use are dependent on the individual card and the potential cardholder. Personal credit cards easily make up the largest portion of the credit market.

Business Credit Cards

Business credit cards usually come with higher spending limits, mainly because of the specific purchases that come with business expenses. Some business credit cards come with the ability to add employees to the account at no extra fee. Additionally, business credit cards are a must if you want to make tax season a breeze.

With that in mind, here are the most popular different types of credit cards on the market. Note that most of them fall under the personal credit card category.

- Balance Transfer Credit Card

- Low-interest/APR Credit Card

- Travel Credit Card

- Cashback Credit Card

- No Annual Fee Credit Card

- Business Credit Card

- The Best Business Checking Accounts

- Student Credit Card

Travel Rewards Credit Cards

The best credit cards for travel rewards allow you to rack up reward points for certain purchases. The three most common types of points are airline miles, hotel points, and bank points.

Airline miles are usually tied to an airline loyalty program. Some examples are Delta SkyMiles or United MileagePlus miles. These points can be used for flights on the parent airline’s flights or on its partners.

Like airline miles, hotel points are restricted to one hotel chain. Some examples are Starwood Preferred Guest and World of Hyatt, which has a new hotel credit card. You can use hotel points for hotel stays or even transfer them to airline partners in some cases.

Bank points can be used for everything from cash back to paid travel. They can also be transferred to the airlines of your choice. Bank points are popular because they offer flexibility that airline miles and hotel points don’t.

Read More About Travel Reward Credit Cards

- Best Credit Cards For Travel Miles

- Beginner’s Guide to Points and Miles

- Don’t Apply for Any New Travel Credit Cards If You Don’t Know Your Credit Score

- 7 Myths About Travel Reward Credit Cards and Your Credit Score

- Best Travel Rewards Credit Cards 2024

- Which Credit Cards Have Roadside Assistance?

- Credit Score Needed for the Best Travel Rewards Credit Cards

- 6 Travel Credit Cards with Good Bonuses

- How To Avoid Baggage Fees By Using Credit Cards

- Credit Cards That Offer Trip Delay Insurance

- Best Credit Cards For International Travel

Popular Travel Reward Credit Cards

Learn more about Chase Sapphire credit cards:

- Chase Sapphire Preferred Credit Score – What You Need To Know

- Chase Sapphire Reserve Credit Score Requirements

- Guide to Chase Sapphire Reserve & Preferred Application Rules

- Chase Sapphire Reserve vs Chase Sapphire Preferred

- Chase Sapphire Reserve Benefits

- Applying for the Chase Sapphire Reserve

- Chase Sapphire Reserve Review: Worth the $550 Annual Fee?

- Do Chase Ultimate Rewards Points Expire?

- Chase Sapphire Preferred vs Capital One Venture

- The Best Chase Credit Cards

- Platinum Card from American Express

Learn more about the Platinum Card from American Express:

- What is the Credit Score Needed for the American Express Platinum?

- How Hard Is It To Get the American Express Platinum Card?

- American Express Credit Cards for Travel Rewards

Learn more about the Capital One Venture cards:

- Capital One Venture: Credit Score Needed for Approval?

- How To Redeem Capital One Venture Miles For Maximum Value

- Capital One Venture vs VentureOne Credit Cards

- Capital One Venture

Learn more about the IGH Premier Card:

Other Credit Card Reviews:

Airline Rewards Credit Cards

Unlike rewards credit cards, airline miles are usually tied to an airline loyalty program. If you are a frequent flyer, you could use the perks for air travel. If you are a frequent flyer who is loyal to a specific airline and finds the airline easily accessible, take advantage of the airline benefits that come with the airline miles credit card.

Some of the benefits that come with airline credit cards include discounts on in-flight purchases, free checked bags, and opportunities to earn miles on select purchases. Additionally, seat upgrades, airport lounge access, and even free flights are also a possibility, depending on the card.

However, know that airline credit cards tend to have higher annual fees. Some users report that the benefits aren’t enough to offset the costs of having a specific airline credit card. Be realistic about how often you fly and whether or not the flights will be accessible to you.

Read More About Airline Rewards Credit Cards

- The Best Credit Cards for Purchasing Flight Tickets

- Airlines that Offer Mileage Pooling

- What is the Best United Airlines Credit Card?

- The Best Credit Cards to Use for Delta Airlines Purchases

- How to Get TSA PreCheck & Global Entry Access for Free

Popular Airline Rewards Credit Cards

- Delta Airlines Credit Cards

- Best American Airlines Credit Cards

- Best Southwest Airlines Credit Cards

- Avianca Lifemiles Credit Cards

- Best United Airlines Credit Cards

Business Credit Cards

If you own a business, consider using a business credit card for many reasons, including better financial management. Keeping your business expenses on your business card will make your life easier when you are doing your taxes. You’ll have detailed records of your spending, making it easier to claim deductions and verify questions should you get audited.

If your employees also have a card, you can see who spent what and where.

There are also higher spending limits to take advantage of with a business credit card. Perks include additional cards for employees, better welcome bonus offers, purchase protections, and rewards for spending on business expenses such as advertising, office supplies, and telephone and internet services.

Additionally, a business credit card can help you build your business credit score, which is different from your personal credit score (even if you’re self-employed). Just like with a personal credit score, having a good business credit score will help you expand your credit limit and utilize the perks that issuers are offering.

Read More About Business Credit Cards

- Applying for a Business Credit Card? Here’s What You Need to Know

- 5 No Annual Fee Business Credit Cards

- Chase 5/24 Rule and Business Credit Cards

- The Best Non 5/24 Rule Chase Credit Cards

- Best Amex Business Credit Cards

- Best Chase Business Credit Cards

Popular Business Credit Cards

- Ink Business Unlimited® Credit Card

- Ink Business Preferred® Credit Card

- The Ink Business Cash® Credit Card

- Capital One Spark Cards

- The Business Platinum Card® from American Express

- American Express® Business Gold Card

Learn more about the Chase Ink Business cards:

- Comparison: Chase Ink Unlimited vs Chase Ink Cash

- Chase Ink Preferred vs. Chase Ink Cash

- What is the Best Chase Business Credit Card?

Hotel Rewards Credit Cards

Hotel rewards credit cards often come with perks like free nights, awards, room upgrades, and free breakfast. Similar to airline credit cards, many hotel credit cards are co-branded, meaning that they are named after the hotel. If you are loyal to a particular brand of hotel, a hotel rewards credit card can help you maximize all that the hotel offers.

Other perks usually include late check-out/early check-in options, access to their exclusive clubs, and guaranteed rooms. On a personal level, hotel rewards credit cards sometimes come with automobile and baggage insurance. Be sure to double-check what you have or want to be approved for.

Don’t forget to sign up for their hotel rewards program, especially if you travel to this particular hotel chain often. If you tend to book your hotels based on price and therefore vary your options, consider a more general card to earn the most.

Read More About Hotel Rewards Credit Cards

Popular Hotel Rewards Credit Cards

Learn more about Hilton Honors credit cards:

- Perks of Hilton Honors Points

- What Is the Best Hilton Honors Credit Card?

- Should You Get the Hilton Honors Ascend or the Hilton Honors Aspire Card?

For rates and fees of the American Express® Business Gold Card, please click here.

For rates and fees of The American Express Blue Business Cash™ Card, please click here.

And For rates and fees of The Blue Business® Plus Credit Card from American Express, please click here.

And for rates and fees of The Business Platinum Card® From American Express, please click here.

For rates and fees of The Platinum Card® from American Express, please click here.

And For rates and fees of the American Express® Gold Card, please click here.

For rates and fees of the Delta SkyMiles® Gold American Express Card, click here.

And For rates and fees of the Blue Cash Everyday® Card from American Express, please click here.